Taking a look at XPO Logistics

In RRR28, I talked about my friend and I helping to hold one another more accountable on our investments.

Below, you’ll find the output of some of that work — I actually presented this to my buddy over some tea 🍵.

In this particular instance, I’ve owned shares of XPO since June of last year, and doing this deep dive aided me in making the decision to trim the position fairly substantially.

Embarrassing to sell some shares so quickly, but that is in fact the whole point of this exercise.

It’s better to have real conviction than not stay up to date with what your money is tied up in.

I hope you enjoy!

*Obviously not investment advice*.

Company Overview

XPO Logistics is a transportation and logistics company that helps businesses move their goods from one place to another. Think of them as a large-scale shipping and delivery company that primarily focuses on:

Less-Than-Truckload (LTL) Trucking - They operate a large fleet trucks to transport goods across the country. More on LTL in a bit.

Freight Management - They help companies figure out the best ways to ship their products

Warehousing - They store products for companies

Last-Mile Delivery - They deliver large items like furniture and appliances to people's homes

They're particularly known for handling heavy or bulky items that are difficult to ship, like furniture, appliances, and industrial equipment. In essence, they're a key middleman that helps products get from manufacturers to stores or directly to customers.

What is LTL?

● LTL is freight transportation where a carrier combines multiple shipments from different customers (shippers) in a single truck, a delivers to the customers of the shippers (consignees). The key here is multiple customers having shipments in the same truck (i.e. Less-Than-Truckload).

● These shipments are typically too large for carriers like UPS/FedEx but too small to fill an entire trailer

● Think of it as freight "sharing" - multiple shippers share space on the same truck to split the transportation costs. Uber Pool for shipping.

Financials

Revenue

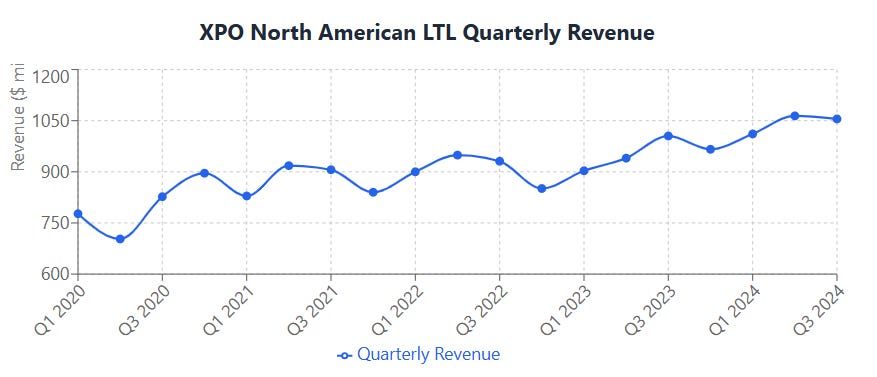

Q3 2024 revenue was $2.05 billion, up 4% year-over-year

North American LTL segment revenue grew 2% YoY in Q3 2024

European Transportation segment revenue grew 7% YoY in Q3 2024

Profitability

EPS of $0.79 in Q3 ‘24, up from $0.72 YoY

Net Income of $95M in Q3 ‘24, up 11% YoY

Operational Efficiency Metrics

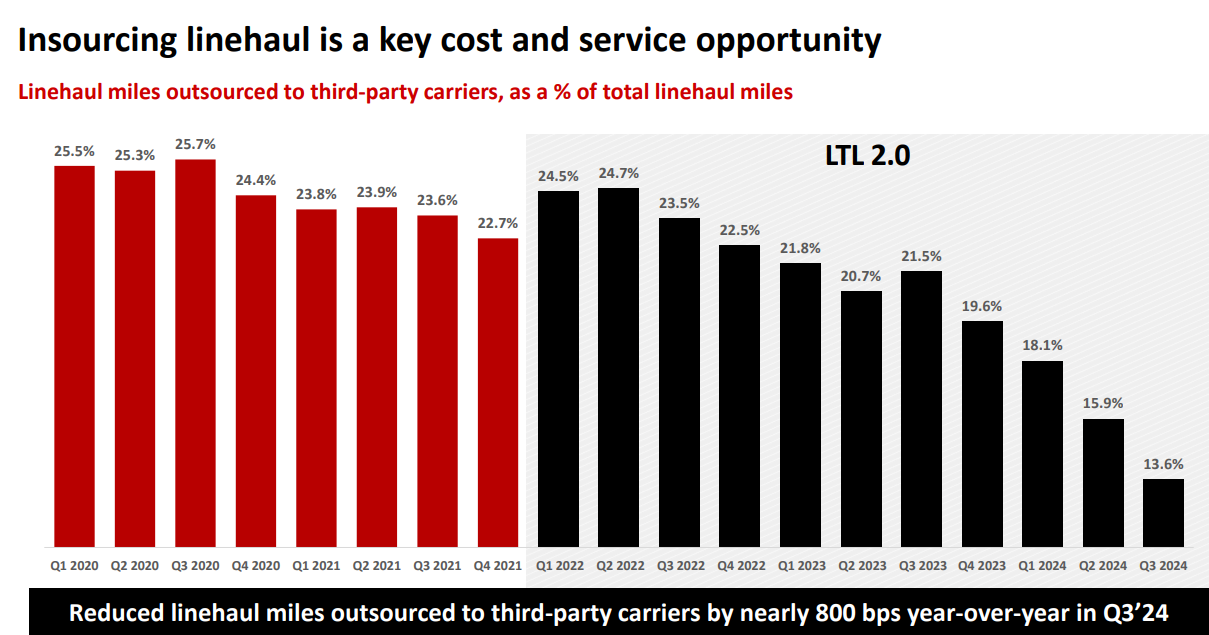

Reduced outsourced miles to 13.6%

Shipments from local customers (a key growth area) grew 10% YoY

Operationalized 21 of 28 new service centers with the last 7 planned to be online in 1H ‘25

Competition

Market Position:

XPO is the 3rd largest LTL carrier by 2023 revenue

They have approximately 9% market share in the LTL industry

The top 10 LTL players hold about 75% of the US LTL market

Key Competitors:

ODFL (Old Dominion Freight Line)

SAIA

Estes

Yellow (which went bankrupt in 2023)

FedEx Freight

ARCB (ArcBest)

Comparative Performance:

Service Metrics:

XPO has improved damage claims ratio to 0.2% in Q3 2024, down from 1.2% when they started their LTL 2.0 initiative

They've improved on-time performance for 10 consecutive quarters

Made progress in customer service rankings and was "most improved on a two-year stack" in NPS scores

Financial Performance:

XPO was "the only public LTL carrier to expand margin in the third quarter" of 2024

They've delivered nearly 400 basis points of OR (Operating Ratio) improvement for four consecutive quarters in a soft freight market

Their yield growth has outpaced the market

Network/Capacity:

Added 28 new service centers (21 operational as of Q3 2024)

Will have approximately 30% excess door capacity when all new centers are operational

Covers 99% of US zip codes

Competitive Advantages:

They are the only US freight transportation company that manufactures its own trailers

This allows for capacity potential that can be realized on their own timing, which can lead to cost advantages and more adaptability to quick shifting needs

Cost advantages would include cheaper production costs vs. ordering trailers from third party manufacturers

Premium services lead to higher pricing power than most competition, longer and healthier customer relationships, and represents an increasing amount of revenue with improving margins YoY.

Premium services include cross-border with Mexico, tradeshow services leveraging their new logistics center in Las Vegas, and retail focused services (coordinated shipping for multiple vendors during large retail campaigns like Halloween, Christmas, or Black Friday).

The company appears to be performing well against competitors, particularly in terms of margin improvement and service metrics. However, they still indicate they have opportunities to close gaps with "best-in-class" carriers, particularly in pricing where they note a "mid-teens pricing gap" versus best-in-class competitors that they are working to close.

Key Risks

Highly Cyclical

Less economic activity directly correlates with XPO bottom line

Significant industry capacity

Many other capable carriers could lead to price competition especially if macro-environment remains challenged

High level of continued investment needed to maintain quality of fleet, technology, etc.

Improving but still elevated leverage ratio of 2.5X

End of 2023: 3.0x

Q1 2024: 2.9x

Q2 2024: 2.7x

Q3 2024: 2.5x

Investment Thesis

XPO represents a potentially compelling investment opportunity driven by management's proven execution capabilities and clear strategic vision. Under CEO Mario Harik's leadership, the company has demonstrated consistent operational improvements through its LTL 2.0 strategy, with damage claims ratio improving from 1.2% to 0.2%, yield growth consistently outpacing the market, and adjusted operating ratio improving year-over-year. The company has shown strong financial discipline by steadily reducing its net leverage ratio from 3.0x at the end of 2023 to 2.5x as of Q3 2024, while simultaneously reinvesting significantly in the business through strategic fleet upgrades and service center expansions.

The upcoming divestiture of XPO's European operations, which management has indicated is a priority, should further strengthen the company's financial position. With the European business holding leading market positions across multiple countries and demonstrating improving performance (7% revenue growth in Q3 2024), the sale should generate meaningful proceeds that can accelerate XPO's path to an investment-grade credit profile while enabling complete focus on its core North American LTL business. Combined with management's track record of successful strategic divestitures (including GXO and RXO) and demonstrated ability to drive operational improvements, XPO appears well-positioned for the future. The largest impediment to XPOs short to mid-term prospect would be macroeconomic instability.