RRR33: Data Lakehouses, My New Gym, Income Tax Burden, America's GDP, and the NYFIP

🏞️🏠🤸🏻♀️⛹🏻♂️💵💲🎈🏀

I’ve been trying to nail down a good analogy around how data tools (if that is even an appropriate name) give you almost everything you need in a lot of situations, but not quite. Often, you need an additional tool to realize that last 10% you’re looking for.

Think of a Venn Diagram that’s close to a full circle:

I was thinking it’s a bit like streaming services, but there’s more complexity with the data tools.

In a single cloud computing platform, there are so many options to do the same thing that it can become paralyzing to make a decision on what you should use, not to mention trying to optimize your data architecture 🛠🌉.

As if the sheer functionality / optimal path isn’t hard enough to parse, the terminology used is just painful:

Data pipeline, data wrangling, ETL, data cleansing, data prep, data transformation, data mart, data warehouse, data lake…

DATA LAKEHOUSE!?!?

Seriously, who comes up with this stuff?

It’s this kind of nonsense jargon that makes most industries / domains seem unapproachable. We should do better.

In Recent Times…

I can’t lie to myself anymore, I am exhausted with cold/dark winters.

Could I be better? Could I get outside for some morning walks, and do a better job of seeking out some winter activities like snowshoeing and skiing? Sure.

But my god, the warm weather makes it feel like you’re playing the game of life on the easiest level.

One thing I was really struggling with towards the end of the winter was working out hard.

The cumulative effect of prolonged dark and cold just took a lot of fuel out of my body, and I felt like I wanted to go home after 15 minutes in the gym 😪💤.

Now that we’ve had a month of increasingly inviting climate, I’m still dodging the gym, but in favor of getting strong outside 🤷🏻♂️.

Here’s my routine:

Ride my bike 7 miles out

Stop on the way home at the dip bars, alternating dips with rounds of jump rope

Bike a little further to the pull up bars

Alternate pullups and pushups

Bike home

All I bring is water, my rope, and a resistance band to help me squeak out some extra pullups towards the end.

It takes me about an hour and a half to complete the cycle. It’s also infinitely more satisfying to my brain than going to the gym…

And I’m getting better results too! The quality of the environment is playing a role in the quality of my outcomes.

In particular, I’ve enjoyed the jump rope routine. I alternate between using my licorice rope and my rope with weighted handles.

The licorice rope, which is more standard, moves quickly and helps improve foot speed. The weighted handles really give your forearms and rotator cuffs a good burn after a while.

In total, the two ropes cost me $35.

It’s also fun, and serves as a bit of a creative outlet once you learn a few tricks or different jumping techniques.

If I listen to music while I jump, it kind of feels like I’m dancing 🕺🏻.

Content Corner 📖🎙📺

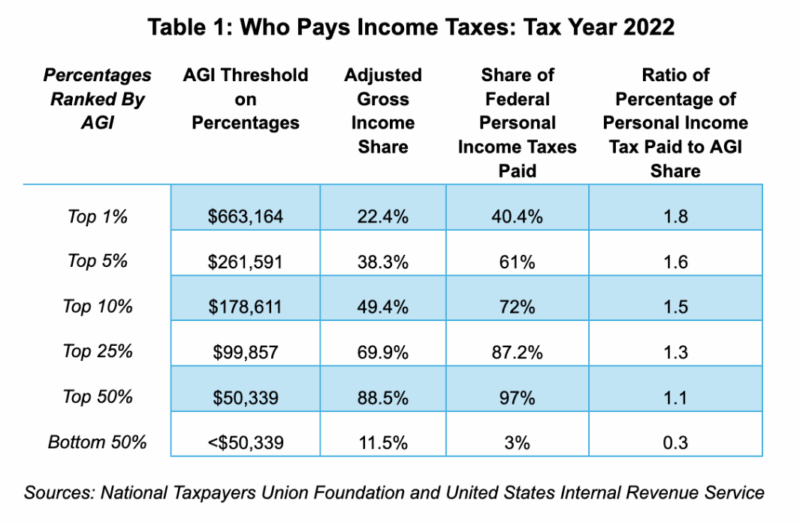

I loved this article because it critically examined the claim that wealthy Americans aren't contributing a “fair” amount in taxes.

As it turns out, federal tax data shows high earners do in fact pay a disproportional amount of the overall tax burden.

This shows us clearly that the popular narrative about the wealthy not paying a lot in taxes is often overstated and lacks nuance. Here’s a table shared in the article:

**IT IS EQUALLY IMPORTANT TO NOTE** — the article doesn’t deny the existence of economic inequality. Instead, it simply acts as a counterbalance to emotionally charged claims, urging us towards a more careful analysis.

When I shared this article with a family member, I added a few of my own thoughts.

One point I raised was about the capital gains tax. Under current U.S. law, long-term capital gains (i.e. securities held more than a year) are taxed at a flat 20%, regardless of the size of the gain.

Ultimately, someone earning $500 in gains is taxed at the same rate as someone earning $1 billion. That feels like a missed opportunity for progressivity and a candidate for a measured reform.

I also emphasized that the wealthy’s capital rarely sits idle. This is so important.

Wealth tends to be deployed — think about the millions of dollars a super-rich person has sitting in their high-yield savings account. That money doesn’t just sit there… it enters the economy in a myriad of ways.

Your 401k? It doesn’t sit there either — the funds you own utilize that capital throughout the global economy.

While it’s important to address mechanisms that perpetuate entrenched wealth, it’s also essential to avoid framing all capital ownership as exploitive or extractive. Productive capital allocation plays a critical role in advancing economic progress, just as it always has.

The article doesn't present a comprehensive solution to wealth inequality, but it does encourage more sober, fact-based discourse.

If we want to tackle inequality effectively, we need to move beyond slogans and toward sharper thinking about the tools we use and the outcomes we want.

Taming the Psoas Muscle — Mover’s Odyssey

I’ve been dealing with some extreme S.I. joint pain lately, stemming from over activity during basketball season.

This video (like all the Mover’s Odyssey videos), is succinct in describing the human physiology component, the movement that it affects, and how to strengthen / stabilize.

I honestly didn’t even know what the Psoas was…

Is America’s GDP Inflated? 🏭📈🎈

Americans love to celebrate our eye-popping GDP figures, but when was the last time we took an honest accounting of what underpins that metric?

There are many things that play a role in our GDP numbers, but if you look at it objectively, it’s hard not to feel there is an uncomfortable relationship to America’s role in the global order.

Should that role in the global order change to become less-favorable to the United States, there may be unprecedented deflationary pressure on our economy.

Valéry Giscard d'Estaing used the term “exorbitant privilege” to describe the benefits realized by the U.S. economy as a result of the dollar being the global reserve currency.

Essentially, exorbitant privilege means a lot of the dollars we use to buy goods from other nations returns back into our economy in the form of investments, as those countries need dollar-based avenues to do business with the rest of the world.

That means we are allowed to run up eye-popping deficits annually at a lower-interest rate than we should be allowed to enjoy, which artificially supports a quality of life / living standard that would be unrealistic for other nations with such vulnerable financial positions.

This isn't an argument to abandon GDP — it's simply about questioning whether the “objective” measures of prosperity we often refer to are perfectly reflective of our economic might, or merely the result of a well-established global pecking order that is undergoing a transformation.

As we rapidly reconfigure our approach to global trade through tariffs and other measures, we may be inadvertently accelerating a reckoning with this uncomfortable question.

What would remain of America's impressive GDP figures if the privileges of our position in the world began to fade?

I hope to never get an answer on that.

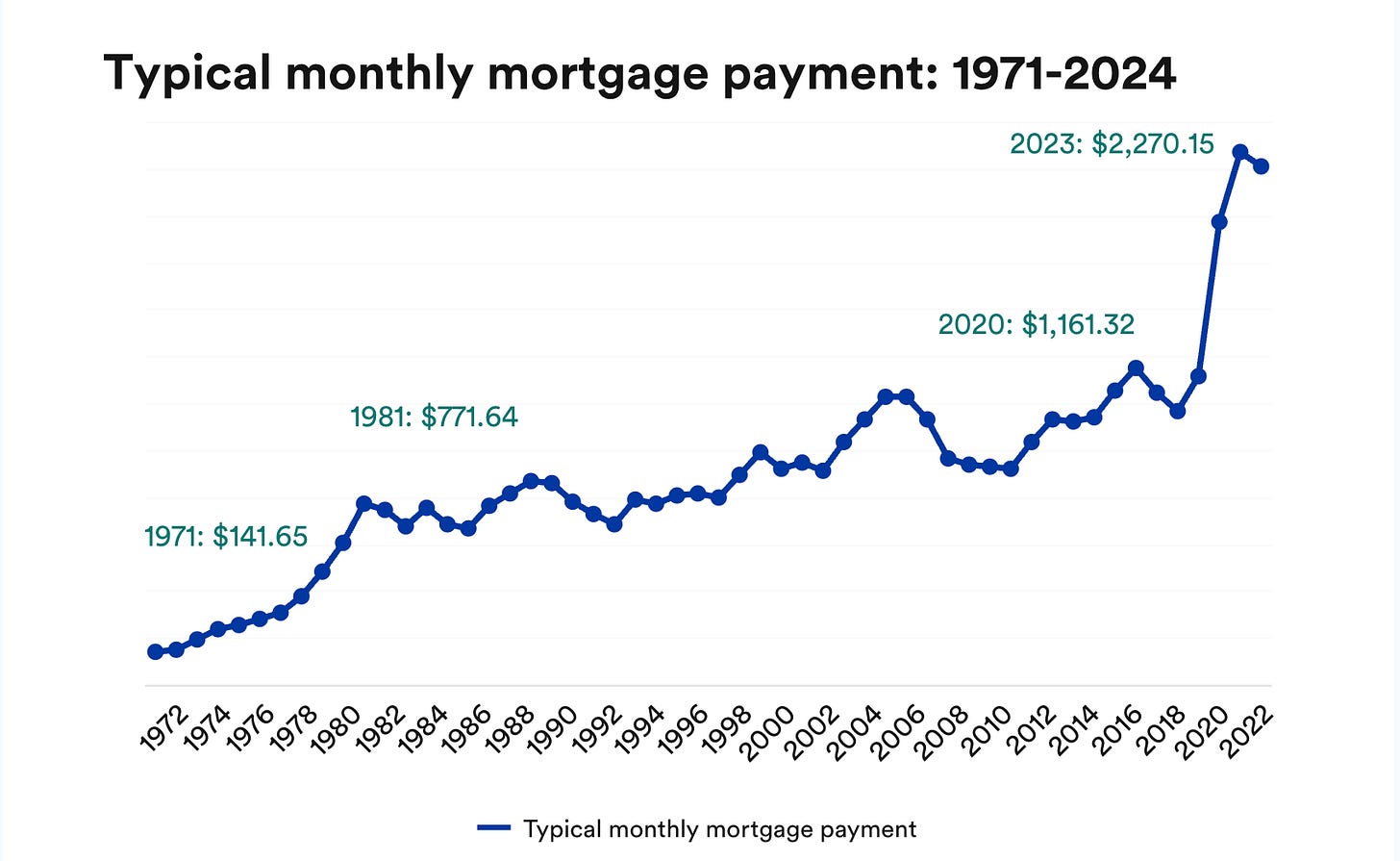

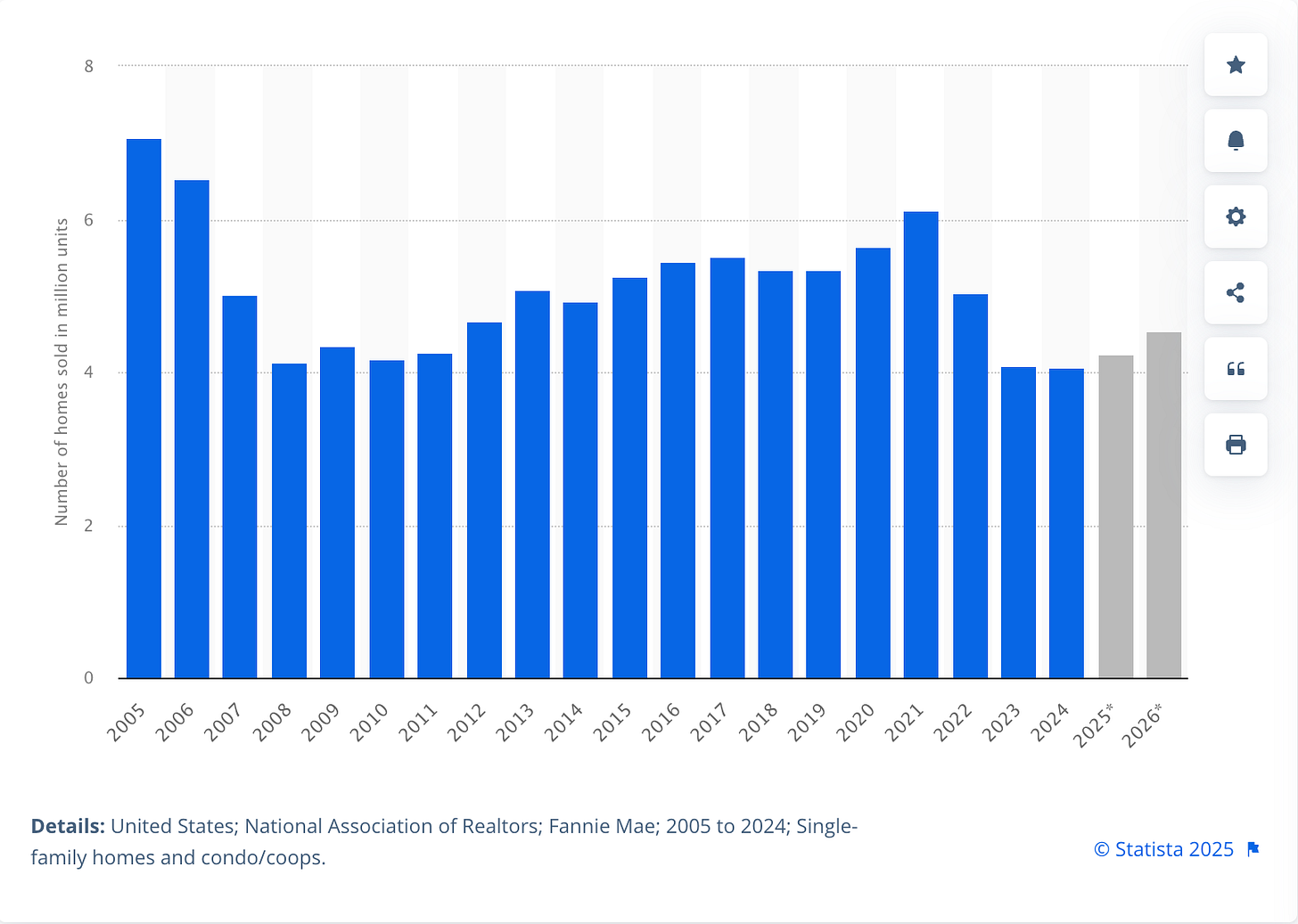

U.S. Housing Still A Disaster

If ever it felt like an issue was underserved in American public discourse, it’s the inaccessibility of homeownership.

The situation is so brutal that even with historically low demand for homes, there’s little hope in the short term of affordability making an appearance on stage.

A drop in interest rates would likely just increase housing demand while doing little to increase supply.

The problem will not meaningfully relent until we have abundant housing supply, which by the way, would not be great for existing homeowners! Especially the ones who bought recently during the historically steep affordability environment.

At this rate, I’m mentally prepared to rent for quite a bit longer.

Not Your Father’s Indiana Pacers

The Indiana Pacers are no joke — they’ve just reached their second consecutive Eastern Conference Finals appearance by dismantling a historically good Cleveland Cavaliers team. They’ve done it as a team in the truest sense of the word, leaning on a brand of basketball rooted in intelligence, toughness, cohesion, and sure, an offensive genius in Tyrese Haliburton.

Haliburton sets the tone. He plays at a uniquely torrid tempo, manipulates defenses, and delivers timely, precise passes while limiting turnovers. His speed, poise and vision are the engine behind an offense that extracts maximum goodness out of every possession.

Around him, the Pacers thrive as a collective. Andrew Nembhard is a revelation. Pascal Siakam provides serious scoring punch, athletic prowess, and size. Aaron Nesmith plays with relentless effort on both sides of the ball and is a feel-good story after his early years in Boston. Obi Toppin adds vertical explosiveness and is knocking down his open looks. Myles Turner anchors the paint and stretches the floor.

Their style is unmistakably intentional. Every cut has a purpose. Every pass works toward a better shot. The team operates with clarity, awareness, and trust.

In an NBA era defined by star-driven drama and highlight reels, the Pacers are proof that sharp execution and shared purpose can still win. Their brilliance is quieter — but you can hear them now.

P.S. — Caitlin Cooper, one of the best basketball writers / minds on the planet, has a Patreon where she posts video analysis and written breakdowns on all things Indiana Pacers. I’ve been following her for a couple of years and can safely say I’ve not come across more informed and thought-provoking basketball content.

Here’s a free article / video she recently published after the Pacers reached the third round of the playoffs .